One Ring to Rule Them

The wholesale destruction of all of Lebanon by Israel and the US Pentagon does not make any sense. Why bomb roads, bridges, ports, fuel depots in Sunni and Christian areas that have nothing to do with Shiite Hizbullah in the deep south? And, why was Hizbullah’s rocket capability so crucial that it provoked Israel to this orgy of destruction? Most of the rockets were small katyushas with limited range and were highly inaccurate. They were an annoyance in the Occupied Golan Heights, especially the Lebanese-owned Shebaa Farms area. Hizbullah had killed 6 Israeli civilians since 2000. For this you would destroy a whole country?

It doesn’t make any sense.

Moreover, the Lebanese government elected last year was pro-American! Why risk causing it to fall by hitting the whole country so hard?

And, why was Condi Rice’s reaction to the capture of two Israeli soldiers and Israel’s wholesale destruction of little Lebanon that these were the “birth pangs” of the “New Middle East”? How did she know so early on that this war would be so wideranging? And, how could a little border dispute in the Levant signal such an elephantine baby’s advent? Isn’t it because she had, like Tony Blair, been briefed about the likelihood of a war by the Israelis, or maybe collaborated with them in the plans, and also conceived of it in much larger strategic terms?

I’ve had a message from a European reader that leads me to consider a Peak Oil Theory of the US-Israeli war on Lebanon (and by proxy on Iran). I say, “consider” the “theory” because this is a thought experiment. I put it on the table to see if it can be knocked down, the way you would preliminary hypotheses in a science experiment.

The European reader writes:

‘When I was in Portugal I also watched a presentation by a guy who works for the ministry of energy in that country, a certain [JFR].

He started his presentation with the growing need for oil in China and India. He stressed that China wants to become the ‘workshop’ of the world and India the ‘office’ of the world. both economies contributed combined some 44% to world economy growth during 2001-2004. He compared the USA, Japan, India and China to giant whales constantly eating fish. They had no fish near them so they started to move. He explained that the Persian Gulf is the ‘fish ground’, the ‘gas station’ of the world.

Later on he explained the . . . hypothesis . . . that says demand for oil will continue to grow. also for natural gas, which is even better than oil. Sadly the existing production is getting smaller, these fields are getting emptied. [One oil major] seems to believe that the gap between demand and existing production will become so large by 2015 that economic growth cannot continue. Yet there is hope on the horizon.

JFR strongly denied that there is going to be an oil peak. He says, and the oil multis seem to agree with him [- my link, JRC], that there is more than enough untouched oil and natural gas. The stupid thing: it is further to the east. Partly in Russia, but most of all, in Iran.

JFR explained to the astonished audience that Iran was the most valuable country on the planet. They have one of the biggest holdings of gas and oil reserves in the world. second in gas, second in oil. On top of that they have direct access to the Persian Gulf, the Arabian Sea and the Caspian Sea what makes them a potential platform for the distribution of oil and gas to South Asia, Europe and East Asia. JRF called Iran ‘the prize’ . . .

The disaster in Lebanon actually was also part of JFR’s presentation. He explained that the US government is 100% convinced, fanatically and completely convinced, that both, Hamas and Hizballah are creatures of Iran and that Iran uses them to undermine US goals in the region . . .

The presentation got kind of freaky then. He said the US government wanted to stop state-controlled Iranian or Chinese (or Indian) companies from controlling the oil. JFR says the US Government is convinced that this battle will decide the future of the world. It sounded like he was talking about ‘the one ring’ in lord of the rings. he who controls Iran controls them all. ‘

It is very important that some EU analysts see things this way. They are in contact with their American counterparts, and may be reflecting a wider North Atlantic view and speaking more openly than is common in Washington.

It is true that Iran’s regime is hostile to US corporate and investment interests. Iran itself has substantial energy resources, many of them undeveloped, but they are locked up by state-owned Iranian companies.

Iran is astride the Oil Gulf, which has the majority of the world’s proven gas and petroleum reserves. Iran has a silkworm missile capability that could interfere with oil tankers in the Straits of Hormuz. It also has emerged as the most influential country in oil-rich South Iraq, which is, like Iran, Shiite Muslim.

Iran is no credible military threat to the United States, though US warmongers are always depicting it as such, rather as they manufactured ramshackle 4th-world Iraq into a dire military menace to the US, allowing for a war of choice to be fought against it.

The regime in Iran has not gone away despite decades of hostility toward it by Washington, and despite the latter’s policy of “containment.” As a result, US petroleum corporations are denied significant opportunities for investment in the Iranian petroleum sector. Worse, Iran has made a big energy deal with China and is negotiating with India. As those two countries emerge as the superpowers of the 21st century, they will attempt to lock up Gulf petroleum and gas in proprietary contracts.

(Since it is already coming up in the comments, I should note that the “fungibility” (easy exchange) of oil is less important in the new environment than it used to be. US petroleum companies would like to go back to actually owning fields in the Middle East, since there are big profits to be made if you get to decide when you take it out of the ground. As Chinese and Indian competition for the increasingly scarce resource heats up, exclusive contracts will be struck. When I floated the fungibility of petroleum as a reason for which the Iraq War could not be only about oil, at a talk at Columbia’s Earth Institute last year, Jeffrey Sachs surprised me by disagreeing with me. In our new environment, oil is becoming a commodity over which it really does make sense to fight for control. See below.*)

In a worst case scenario, Washington would like to retain the option of military action against Iran, so as to gain access to its resources and deny them to rivals. If Iran gets a nuclear weapon, however, that option will be foreclosed. Iran may not be trying for a weapon, and if it is, it could not get one before about 2016. But if it had a nuclear weapon, it would be off limits to US attack, and its anti-American regime could not only lock up Iranian gas and oil for the rest of the century by making sweetheart deals with China. It also might begin to exercise a sway over the small energy-producing countries of the Middle East. (The oil interest would explain the mystery of why Washington just does not care that Pakistan has the Bomb; Pakistan has nothing Washington wants and so there was no need to preserve the military option in its regard.)

Even an Iranian nuke, of course, would not be an immediate threat to the US, in the absence of ICBMs. But the major US ally in the Middle East, Israel, would be vulnerable to a retaliatory Iranian strike if the US took military action against Iran in order to overthrow the regime and gain the proprietary deals for themselves.

In the short term, Iran was protected by another ace in the hole. It had a client in the Levant, Lebanon’s Hizbullah, and had given it a few silkworm rockets, which could theoretically hit Israeli nuclear and chemical facilities. Hizbullah increasingly organizes the Lebanese Shiites, and the Lebanese Shiites will in the next ten to twenty years emerge as a majority in Lebanon, giving Iran a commercial hub on the Mediterranean.

China and India could get Iran, and Iran could get Lebanon, and as non-OPEC energy production decreases, the US and Israel could find themselves out in the cold on the energy front.

As for Iran, the DOE says this:

‘ Iran’s largest non-associated natural gas field is South Pars, geologically an extension of Qatar’s North Field. Current estimates are that South Pars contains 280 Tcf or more (some estimates go as high as 500 Tcf) of natural gas, of which a large fraction will be recoverable, and over 17 billion barrels of liquids. Development of South Pars is Iran’s largest energy project, already having attracted around $15 billion in investment. Natural gas from South Pars largely is slated to be shipped north via the planned 56-inch, 300-mile, $500 million, IGAT-3 pipeline, as well as planned IGAT-4 and IGAT-5 lines. Gas also will be reinjected to boost oil output at the mature Agha Jari oil field, and possibly the Ahwaz and Mansouri fields. Besides condensate production and reinjection/enhanced oil recovery, South Pars natural gas also is intended for export, by pipeline and also possibly by liquefied natural gas (LNG) tanker. Sales from South Pars could earn Iran as much as $11 billion per year over 30 years, according to Iran’s Oil Ministry. ‘

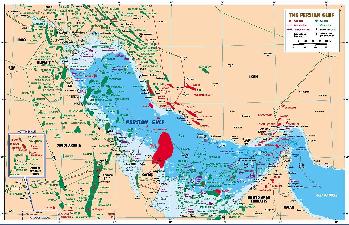

Persian Gulf Fields

and this is why Iran’s reserves are even more important:

‘ The Persian Gulf contains 715 billion barrels of proven oil reserves, representing over half (57%) of the world’s oil reserves, and 2,462 Tcf of natural gas reserves (45% of the world total). Also, at the end of 2003, Persian Gulf countries maintained about 22.9 million bbl/d of oil production capacity, or 32% of the world total. Perhaps even more significantly, the Persian Gulf countries normally maintains almost all of the world’s excess oil production capacity. As of early September 2004, excess world oil production capacity was only about 0.5-1.0 million bbl/d, all of which was located in Saudi Arabia.’

Non-OPEC production will decline sharply in coming years, increasing the importance of the Persian Gulf region. The point about excess capacity is this: The US in 2005 produced over 7 million barrels of petroleum a day, but consumes all of it, and then imports two times that from abroad (using nearly 22 million barrels a day in 2005). So US petroleum is essentially off the market. But Saudi Arabia produces 9.5 million barrels a day and exports over 7 million of that. It doesn’t use it all up at home. Even now, the excess production is in the Gulf, and that excess production will become more important over time.

It may be that that hawks are thinking this way: Destroy Lebanon, and destroy Hizbullah, and you reduce Iran’s strategic depth. Destroy the Iranian nuclear program and you leave it helpless and vulnerable to having done to it what the Israelis did to Lebanon. You leave it vulnerable to regime change, and a dragooning of Iran back into the US sphere of influence, denying it to China and assuring its 500 tcf of natural gas to US corporations. You also politically reorient the entire Gulf, with both Saddam and Khamenei gone, toward the United States. Voila, you avoid peak oil problems in the US until a technological fix can be found, and you avoid a situation where China and India have special access to Iran and the Gulf.

The second American Century ensues. The “New Middle East” means the “American Middle East.”

And it all starts with the destruction of Lebanon.

More wars to come, in this scenario, since hitting Lebanon was like hitting a politician’s bodyguard. You don’t kill a bodyguard just to kill the bodyguard. It is phase I of a bigger operation.

If the theory is even remotely correct, then global warming is not the only danger in continuing to rely so heavily on hydrocarbons for energy. Green energy–wind, sun, geothermal– is all around us and does not require any wars to obtain it. Indeed, if we had spent as much on alternative energy research as we have already spent on the Iraq War, we’d be much closer to affordable solar. A choice lies ahead: hydrocarbons, a 20 foot rise in sea level, and a praetorian state. Or we could go green and maybe keep our republic and tame militarism.

=========

An informed reader writes:

“Jeffrey Sachs is right. Oil is fungible only after its out of the ground. The name of today’s game is control of reserves, not markets. Example: china’s deals in Latin America, US development of non-Nigerian African resource, etc.”

© 2025 All Rights Reserved

© 2025 All Rights Reserved