By Chuck Collins & Josh Hoxie, | (Institute for Policy Studies) | – –

This report exposes the extreme wealth concentrated within the fortunes of the 400 wealthiest Americans and compares this wealth to the much more meager assets of several different segments of American society.

The report proposes several solutions to close the growing gap between the ultra wealthy and the rest of the country. These policies include closing offshore tax havens and billionaire loopholes in the tax code that the wealthy exploit to hide their wealth.

The report also proposes a direct tax on wealth to break up the concentration of wealth and generate trillions of dollars in new revenue to invest in wealth building opportunities for working families.

KEY FINDINGS:

- America’s 20 wealthiest people — a group that could fit comfortably in one single Gulfstream G650 luxury jet – now own more wealth than the bottom half of the American population combined, a total of 152 million people in 57 million households.

- The Forbes 400 now own about as much wealth as the nation’s entire African-American population – plus more than a third of the Latino population – combined.

- The wealthiest 100 households now own about as much wealth as the entire African American population in the United States. Among the Forbes 400, just 2 individuals are African American – Oprah Winfrey and Robert Smith.

- The wealthiest 186 members of the Forbes 400 own as much wealth as the entire Latino population. Just five members of the Forbes 400 are Latino including Jorge Perez, Arturo Moreno, and three members of the Santo Domingo family.

- With a combined worth of $2.34 trillion, the Forbes 400 own more wealth than the bottom 61 percent of the country combined, a staggering 194 million people.

- The median American family has a net worth of $81,000. The Forbes 400 own more wealth than 36 million of these typical American families. That’s as many households in the United States that own cats.

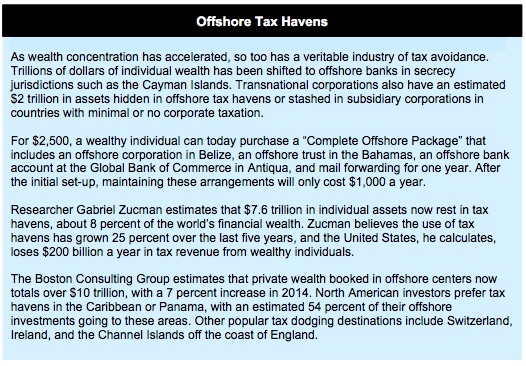

We believe that these statistics actually underestimate our current national levels of wealth concentration. The growing use of offshore tax havens and legal trusts has made the concealing of assets much more widespread than ever before.

Two types of policy interventions can reduce extreme wealth inequality in the United States.

First, we must close wealth escape routes. Wealthy individuals are moving quickly to shift wealth into offshore tax havens and bury it in private trusts, avoiding accountability and taxation every step of the way. This hidden wealth now totals in the trillions. Our first step must be to close these escape routes and tax dodges.

Second, we need to implement policies to reduce concentrated wealth. Without action to directly reduce private concentrations of wealth, inequality will continue to grow. By seriously taxing our wealthiest households, we could raise significant revenues and invest these funds to expand wealth-building opportunities across the economy.

Share the graphics below to spread the word.

The Forbes 400 and the Rest of Us

Over the last decade, a huge share of America’s income and wealth gains has flowed to the top one-tenth of the richest 1 percent, the wealthiest one out of a thousand households.

Within this group, our richest 400 individuals command a dizzying amount of wealth, defined here as total assets minus liabilities. The annual Forbes 400 ranking provides a unique insight into the extreme wealth concentration at America’s economic summit. Forbes began publishing its top 400 ranking in 1982. The total wealth of the latest 400 adds up to $2.34 trillion, a new all-time record and more than the GDP of India, a country with a population of over a billion.

Many members of the Forbes 400 have amassed wealth in their lifetime through successful companies and innovation. But all of the Forbes 400 have also benefited enormously from a system of tax, trade, and regulatory rules tipped in favor of wealth holders at the expense of wage earners. Tax policies, for instance, routinely favor capital income over wage income, and these policies disproportionately benefit the Forbes 400, especially those working in finance.

The United States is becoming, as the French economist Thomas Piketty warns, a hereditary aristocracy of wealth and power. As a society, we must intervene. We need focused public policies to slow and reverse these trends and protect our democracy and social stability.

U.S. Wealth Pyramid Now Space Needle

Photo from Wikimedia Commons/Jordon Kalilich

The level of U.S. wealth inequality has grown so lopsided that our classic wealth distributional pyramid now more resembles the shape of Seattle’s iconic Space Needle.

The bulge at the top of our wealth “space needle” reflects America’s wealthiest 0.1 percent, the top one-thousandth of our population, an estimated 115,000 households with a net worth starting at $20 million. This group owns more than 20 percent of U.S. household wealth, up from 7 percent in the 1970s. This elite subgroup, University of California-Berkeley economist Emmanuel Saez points out, now owns about as much wealth as the bottom 90 percent of America combined.

But these numbers don’t tell the full wealth concentration story. For that story we need to examine our wealthiest 400, a cohort small enough to dine in the rotating luxury restaurant atop the Space Needle in Seattle. These 400 all possess fortunes worth at least $1.7 billion.

Our wealthiest 400 now have more wealth combined than the bottom 61 percent of the U.S. population, an estimated 70 million households, or 194 million people. That’s more people than the population of Canada and Mexico combined.

The higher up you go up our contemporary wealth ladder, the greater the imbalance. Perched atop our distributional space needle rests a Gulfstream G650 luxury private jet. Sitting in its 20 seats: America’s 20 wealthiest individuals.

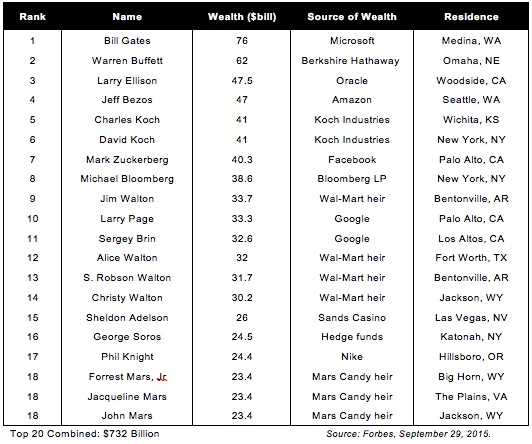

The Top 20 Wealth Holders

The wealthiest 20 individuals in the United States today hold more wealth than the bottom half of the U.S. population combined. These 20 super wealthy — a group small enough to fly together on one Gulfstream G650 private jet — have as much wealth as the 152 million people who live in the 57 million households that make up the bottom half of the U.S. population.

The 20 wealthiest Americans include eight founders of corporations: Bill Gates (Microsoft), Larry Ellison (Oracle), Jeff Bezos (Amazon), Mark Zuckerberg (Facebook), Larry Page and Sergey Brin (Google), Michael Bloomberg (Bloomberg), and Phil Knight (Nike). The list also features nine heirs from families of dynastic wealth: two Koch brothers, four Waltons (Wal-Mart), and three fortunate souls from the Mars candy empire. Rounding out this top 20: investors Warren Buffett and George Soros and casino mogul Sheldon Adelson.

Forbes Top 20

The Forbes 400 and Cats

Another way to contemplate the wealth imbalance the Forbes 400 represents: cats. The typical U.S. household holds $81,000 in wealth. The Forbes 400 have more wealth than 36 million typical U.S. households, as many households that own cats.

The Racial Asset Divide

The United States has a persistent racial wealth divide, the result of a multi-generational legacy of discrimination in asset building that began during slavery and has continued right up to present-day discrimination in mortgage lending.

As of October 2015, the homeownership rate for white Americans stands at 71.9 percent. By contrast, only 42.4 percent of African-Americans own their own homes and only 46.1 percent of Latinos. Ownership of corporate stocks, a valuable store and generator of wealth over time, appears even more skewed, with 55 percent of white households owning at least some stocks, but only 28 percent of African-Americans and 17 percent of Latinos.

In the aftermath of the 2008 economic meltdown, wealth owned by Latino and African-American families declined dramatically as home values collapsed, especially in urban areas. The wealth of America’s richest 1 percent also dropped in the immediate aftermath of the meltdown, but then rebounded quickly in subsequent years, as the stock market recovered. This resurgent market would prove of little help to the majority of African-American and Latino families, households that own no stocks at all.

The billionaires who make up the Forbes 400 list now have as much wealth as all of America’s African-American households, plus one-third of America’s Latino population, combined.

In other words, just 400 extremely wealthy individuals — the number of people who could fit into the swanky 21 Club Restaurant in midtown Manhattan — have as much wealth as 16 million African-American households and 5 million Latino households. An even more striking stat: The wealthiest 100 members of the Forbes list alone own about as much wealth as the entire African American population of 42 million people.

The wealthiest 186 members of the Forbes 400, meanwhile, own as much wealth as the entire Latino population, over 55 million people.

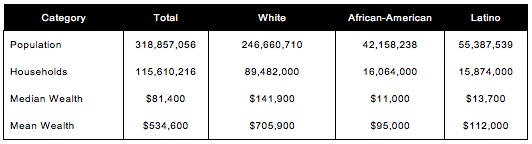

African-Americans overall make up 13.2 percent of the U.S. population, but have only 2.5 percent of the nation’s total wealth. Latinos make up 17 percent of the U.S. population and hold 2.9 percent of total private wealth. (See Table 3)

What about the divide in median wealth? Typical white households in the United States now hold $141,900 in net worth. The African-American household median: $11,000. The Latino: $13,700.

Racial Wealth and Population

Only two African-Americans, Oprah Winfrey (#211 with $3 billion) and tech investor Robert Smith (#268 with $2.5 billion), currently reside within the Forbes 400. The only other African-American billionaire in the United States, Michael Jordan, did not make the $1.7 billion Forbes 400 cut. Jordan’s net worth: $1.3 billion.

Five members of the Forbes 400 come from Latino backgrounds. They include Jorge Perez, the condo king of Miami (#171 with $3.5 billion) and Arturo Moreno, a billboard billionaire and owner of the Los Angeles Angels baseball team (#375 with $1.8 billion). The three remaining Latinos all hail from one family, the U.S. children of the late Colombian beer magnate Julio Mario Santo Domingo, a major shareholder of SABMiller. Alejandro and Andres Santo Domingo sit at #149 on the list with $3.8 billion each, with Julio III at #358 with $1.9 billion.

Why Inequality Matters

According to research across several academic disciplines, extreme inequalities of income, wealth and opportunity undermine democracy, social cohesion, economic stability, social mobility, and many other important aspects of our personal and public lives.

Extreme inequality corrodes our democratic system and public trust. It leads to a breakdown in civic cohesion and social solidarity, which in turn leads to worsened health outcomes. Inequality undercuts social mobility—and has disastrous effects on the economy.

Too much inequality disenfranchises us, diminishing our vote at the ballot box and our voice in the public square. Wealthy donors dominate our campaign finance and lawmaking systems, even after efforts at reform. In the first phase of the 2016 Presidential election cycle, 158 wealthy donors provided half of all campaign contributions.

High inequality makes us sick and undermines public health. Unequal communities have greater rates of heart disease, asthma, mental illness, cancer, and other morbid illnesses. It is well known that poverty contributes to bad health outcomes. But research is showing that you are better off living in a community with a lower standard of living, but greater equality—than living in a community with a higher income, but more extreme inequalities.

Why is this so? According to UK health researcher Richard Wilkinson, communities with less inequality have stronger “social cohesion,” more cultural limits on unrestrained individualism, and greater networks of mutual aid and caring. “The individualism and values of the market are restrained by a social morality,” Wilkinson writes. The existence of more social capital “lubricates the workings of the whole society and economy. There are fewer signs of antisocial aggressiveness, and society appears more caring.”

Extreme inequalities of wealth rip our communities apart with social divisions and distrust, leading to an erosion of social cohesion and solidarity. The wealthy and everyone else today don’t just live on opposite sides of the tracks—they occupy parallel universes. New research shows that we’re becoming more polarized by class and race in terms of where we live. As this distance widens, it is harder for people to feel like they are in the same boat.

Extreme inequality undermines the cherished value of equality of opportunity and social mobility. Intergenerational mobility is the possibility of shifting up or down the income ladder relative to one’s parent’s status. In a mobile society, one’s economic circumstances are not defined or limited by one’s family economic origins.

Today, Canada and those European nations—with their social safety nets and progressive tax policies—are now more socially mobile than U.S. society. Research across the industrialized OECD countries has found that Canada, Australia and Nordic countries—Denmark, Sweden, and Finland—are among the most mobile countries. There is a strong correlation between social mobility and policies that redistribute income and wealth through taxation. The United States is now among the least mobile of industrialized countries in terms of earnings.

Too much inequality contributes to economic instability. Research by the International Monetary Fund (IMF) and the National Bureau of Economic Research point to the fact that more equal societies have stronger rates of growth, longer economic expansions, and are quicker to recover from economic downturns. According to Jonathan Ostry, an economist at the IMF, unequal income trends in the U.S. mean that future economic expansions will be just one-third as long as the 1960s, prior to the widening of the income divide. Less equal societies are more vulnerable to both financial crises and political instability.

Reversing Extreme Wealth Concentration

What can we do to reverse these extreme inequalities of wealth? In this section, we provide an overview of the public policies often proposed to address inequality. We argue that strategies to “raise the floor” and “level the playing field” will be insufficient to reduce the distorting effects of concentrated wealth.

We need public policies that directly address the top-heavy distribution of wealth. Unfortunately, the very wealthy are using offshore tax havens and private trusts to hide wealth and avoid public accountability and taxation. So before we implement our policy agenda, detailed below, we must first address the wealth escape routes.

Aggressive Avoidance at the Top: The Wealth Escape Problem

Calculations by the compilers of the annual Forbes list may understate the net worth of many of those extremely wealthy individuals listed. The Forbes calculations, for example, do not take into account the growing amount of U.S. and global wealth hidden in offshore bank accounts and secrecy jurisdictions. Nor do the Forbes data include the trillions in wealth buried in complicated and opaque trust mechanisms.

An Overview of Public Policies to Reduce Inequality

Most discussions about inequality and public policy focus on a wide range of solutions, from raising the minimum wage to reducing the influence of big money on politics. Canada and many European countries today have significantly less inequality than the United States because these nations have an array of policies that raise the floor, level the playing field, and reduce concentrations of wealth and power.

- Raise-the-floor policies ensure a minimal social safety net and assist workers. These include higher minimum wages, paid sick leave, early childhood education, universal health insurance, and guaranteed minimum incomes. The “Fight for 15” — a $15 per hour minimum wage — represents one active campaign in the United States that aims to raise the floor and reduce inequality.

- Level-the-playing-field policies work to ensure consistent rules across sectors and population segments. The United States should not sport one set of U.S. tax rules for domestic businesses and another set of tax rules for transnational corporations. Similarly, campaign finance reform and the movement towards publicly funded elections could level the playing field between voters of different income levels. Instead, we effectively have a “wealth primary,” as wealthy campaign contributors winnow the field before they stand for a single vote.

- Policies that reduce concentrations of wealth and power directly focus on the top end of the income and wealth distribution. These include progressive taxation and antitrust policies and address the drivers of systemic inequality. Without reducing concentrations of wealth and power, efforts to raise the floor and level the playing field will either be unsuccessful or rendered quickly irrelevant.

We focus below on reducing the concentration of wealth, first through closing wealth escape routes and then via public policies designed to reduce inequality through public investments and revenue enhancements.

PART I: CLOSE OFF WEALTH ESCAPE ROUTES

To effectively reverse the concentration of wealth and power, we need to institute progressive wealth and estate taxes. But these tax policies will not be nearly as effective as they could and should be as long as offshore tax havens and trust mechanisms conceal wealth.

Stop Offshore Abuse

The Stop Tax Haven Abuse Act, introduced in the U.S. House of Representatives (HR 297) by Rep. Lloyd Doggett and in the U.S. Senate (S. 174) by Senator Sheldon Whitehouse, aims primarily at corporate tax avoidance. But several provisions also apply to individual tax dodging, attacking such problems as inadequate bank disclosure and the absence of transparency.

Systematically confronting offshore tax havens will require legislative action, international diplomacy, and sanctions and penalties aimed at both banks and tax haven jurisdictions. Nations must establish treaties requiring uniform disclosure and transparency, both of banks and capital flows. The large nation states have enormous potential leverage here. They could, for instance, sanction micro-states such as Luxemburg and the Cayman Islands by denying them access to trade. In 1962, France took such action against the principality of Monaco, then a tax haven for wealthy French citizens. Several analyses have detailed other possible interventions.

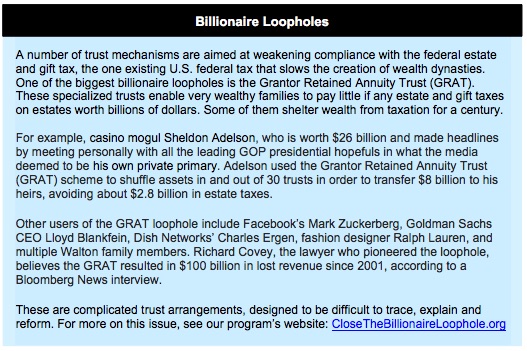

Close Billionaire Loopholes

A number of proposals to close tax-avoidance loopholes have appeared in legislation and in Obama administration budget proposals. One comprehensive approach, the Responsible Estate Tax Act (HR 2907and S.1677) introduced by Rep. Jan Schakowsky and Senator Bernie Sanders, includes a number of provisions to eliminate or reform dynasty trust arrangements. This legislation also aims to make the estate tax more progressive by adding graduated rates on larger estates. The Schakowsky-Sanders proposal would:

- Strengthen the “generation-skipping tax,” which is designed to prevent avoidance of estate and gift taxes, by applying it with no exclusion to any trust set up to last more than 50 years.

- Prevent abuses of Grantor Retained Annuity Trusts (GRATs) by barring donors from taking assets back from these trusts just a couple of years after establishing them to avoid gift taxes (while earnings on the assets are left to heirs tax-free).

- Prevent wealthy families from avoiding gifts taxes by paying income taxes on earnings generated by assets in “grantor trusts.”

- Sharply limit the annual exclusion from the gift tax (which was meant to shield the normal giving done around holidays and birthdays from tax and record-keeping requirements) for gifts made to trusts.

PART II: POLICIES TO REDUCE CONCENTRATED WEALTH

Taxing Wealth

The most effective intervention to address the intense concentration of wealth currently exhibited would be a direct tax on wealth. The idea of a wealth tax dates back to colonial times and currently exists in a number of other countries. But the practice has yet to be implemented in the United States.

The economist Thomas Piketty has made the case for a global wealth tax as a solution to the rising global wealth inequality. But we don’t need to wait for global action on a wealth tax. We can act meaningfully on the national level, and the mechanics of a wealth tax need not be excessively complicated. Cumulative assets could be assessed on an annual basis in the same manner as annual income, with minor exemptions for small, low-value items. A tax would be levied on cumulative assets over a flat exemption level.

The revenue from such a tax would depend on the rates and exemptions described. Consider a tax that subjects just the top 1 percent of wealth holders with a flat levy of just 1 percent. Our top 1 percent currently owns 42 percent of America’s household wealth, about $26 trillion in all. A 1 percent tax on this wealth would generate $260 billion annually or $2.6 trillion over ten years, more than the federal government now spends on education and environmental protection combined. Raising the wealth tax rate and broadening the base of those to be taxed could raise significantly higher revenue.

Alternatively, a more narrow focus — a 1 percent tax exclusively on the Forbes 400, for instance — could raise $234 billion over ten years. For context, that amounts to more money than the government spends on both Head Start, which provides early childhood education to over 800,000 low-income children, and the Women, Infant, and Children (WIC) program that provides nutrition assistance to over half of all infants born in the United States.

The Taxing of Capital Gains as Ordinary Income

As mentioned previously, the owners of capital stocks and other financial assets tend to be white and wealthy. The income generated from the sale of stocks and other financial assets is currently taxed at a lower rate than income generated through traditional work. This special income tax rate, currently 23.8 percent, runs significantly lower than the highest income tax rate of 39.6 percent.

Taxing capital gains as ordinary income would end this preferential treatment for wealthy owners of capital and raise more than $600 billion over ten years, according to the Washington-based group Citizens for Tax Justice. This would inevitably reduce inequality, as those at the very top would pay a much fairer and robust tax on the income their property trading generates.

One small yet particularly nefarious loophole in the capital gains tax gives hedge fund managers the ability to pay taxes on their income at the capital gains rate. Ending this arrangement, known as the carried interest loophole, would raise between $15 billion and $180 billion over ten years, depending on how it is structured.

Progressive Income Taxation

Taxing the highest income households at higher rates would generate substantial revenue and have a negligible personal and economic impact on those households. The top 1 percent includes 1.13 million households with an average annual income of $2.1 million. Top 1 percenters pay an effective tax rate of roughly one-third of their total income in federal taxes. This calculation encompasses not just income taxes, but excise taxes, payroll taxes that fund Social Security and Medicare, estate and gift taxes, and the investor’s share of corporate income taxes.

The ultra-wealthy pay federal taxes at an effective rate far lower, as Warren Buffett, number two on the Forbes 400 list, has helped Americans understand. Buffett has noted that he pays taxes at a lower rate than his secretary. On the other hand, former Presidential candidate Mitt Romney tried to avoid talking about the 14 percent effective federal tax rate he paid on $21 million in annual income in 2010, less than half the highest income tax rate.

According to the Tax Policy Center, if America’s top 1 percent paid federal taxes at an effective 40 percent of their income, instead of the current 33 percent, the federal government would collect $157 billion in the first year. An increase to 45 percent would bring in $276 billion.

Targeting a 40 percent effective tax rate on just the top 0.1 percent, with an average income of $9.4 million, would generate $55 billion in additional revenue annually.

Reinvestment

Taxing the wealthy at higher levels would reduce inequality. Investing the revenue gained through these higher taxes in wealth building for millions of families not featured in the glossy pages of Forbes might decrease inequality even more. A major increase in federal revenue would open the door to wealth-building programs that could lift families out of poverty and into the middle class. Among the potential programs that could be considered:

- Debt-Free College and Student Loan Restructuring

Higher education continues to rise in importance for workers looking to earn a middle class income, but college has become more of a debt sentence then a launching pad, Student debt now tops $1 trillion. The average graduate in 2015 racked up $35,000 in debt, with many going more than six figures into the hole. The high cost of college and high student loan rates create a barrier to education for students from low-income backgrounds and prevent graduates from saving to buy a house or for retirement.

U.S. Senator and Democratic presidential candidate Bernie Sanders has introduced legislation to create a tuition-free public college system at a cost of $70 billion over ten years. The plan would also enable existing borrowers to restructure their loans with lower interest rates. The source of revenue to pay for the plan would be a financial transaction tax, a small levy on trades of stocks and derivatives, which would also help reduce inequality. Presidential candidates Hillary Clinton and Martin O’Malley have also each introduced plans for debt-free higher education.

- Baby Bonds

Children born into the 1 percent come into the world with family wealth guaranteeing at least a modest cushion to fall back on. Children from poor families do not have this same cushion. They struggle to generate savings. Without an initial modicum of wealth, unforeseen shocks like failing health or car problems and long-foreseen costs for education and childcare can devastate young families.

We can reduce this asset gap through individualized development accounts created for infants at birth that earn interest for a continued period until the child reaches adulthood. These child savings accounts (commonly referred to as Baby Bonds or children’s development accounts) have taken hold in some states. Funding for these have usually come from private foundations rather than the public purse.

Former U.S. Senator Robert Kerrey championed legislation, the KidSave Accounts Act, to provide a $1,000 savings account to every child at birth, with an extra $2,500 deposited over the child’s first five years. The funds would grow over time with compounding interest.

For a rough idea of how much a program like this might cost today, consider that 400,000 babies are born annually. Adjusting for inflation, Senator Kerrey’s $3,500 per child in 1995 would now equal about $5,500, making the current cost of the program about $2.2 billion per year. That’s only slightly more than the most conservative estimates for revenue that could be raised by closing the tax loophole hedge fund managers use to avoid paying their fair share of taxes, known commonly as the carried interest loophole.

- Affordable Housing

One of the biggest barriers to generating wealth has been the gap between wages and the cost of housing. As home and rental prices have risen steadily, wages have stagnated, especially at the lower end. The national housing wage, the amount needed to afford market rate housing, now stands at $19.35 per hour, two-and-a-half times more than the current $7.25 minimum wage. As a result, over 9 million low-income families are considered severely cost burdened by housing.

Compounding this problem: the erosion of affordable housing programs that provide adequate housing to the working poor. These housing subsidies provide a lifeline to families in need, most of whom work full-time and still don’t earn enough to save and pay market rent.

Investing in the National Low Income Housing Trust Fund could generate housing for extremely low-income families at a cost of $30 billion over ten years. Increased investments in other rental assistance programs would generate a significant additional impact in the savings potential of low-income families at the brink.

Making a serious investment in housing for working families would enable millions of people to begin to generate savings and start to create wealth. This “raise the floor” approach could easily and effectively be funded by any one of the revenue enhancement programs outlined above. Failing to invest in programs that encourage wealth creation at the bottom perpetuates a wealth gap that concentrates the nation’s resources into fewer and fewer hands.

Conclusion

The Forbes 400 provides a useful snapshot of the nation’s wealthiest individuals, an insight into a world most people will never witness firsthand. The Forbes 400 also provides an insight into just how lopsided our economy has become: Just 400 people hold as much wealth as over 190 million.

To even more accurately depict our current wealth divide, we need further research into the tax-evading strategies the super wealthy employ. But we already know enough to know that our current extreme inequality represents a clear and present danger to our social and economic well-being. We have before us serious policy options for creating a much fairer economy. As Thomas Piketty reminds us, inequality will only continue to grow if we do not act.

Methodology

The two major datasets used in this report were the 2015 Forbes Magazine Forbes 400 and the 2013 Federal Reserve Survey of Consumer Finance (SCF). Forbes has been calculating the wealth of the 400 wealthiest Americans since 1982 and releasing this information in their annual report. The SCF is a triennial survey conducted by the Federal Reserve Board of Governors and widely regarded as the most comprehensive government dataset documenting household wealth. These two datasets provided the basis for wealth estimations of the top 400 as well as the general population and racial populations.

To derive the wealth figures cited for the general population, the SCF Main survey dataset was analyzed using SPSS software and the following methodology. This was completed with exceptional quantitative help from Dr. Salvatore Babones, associate professor of sociology at the University of Sydney, and Tatjana Meschede, Research Director, Institute for Assets and Social Policy.

Wealth figures were calculated using the SCF variable “networth”. Total household wealth was calculated by multiplying the weighted mean net worth for the SCF-2013 sample by the total number of households in the United States as reported by the Census Bureau USA Quick Facts.

Net worth owned by each percentile is calculated based on the SSPS frequency output. First total net worth of each net worth level is calculated by multiplying the net worth by the frequency. Net worth levels are then grouped by cumulative percentile according to the “less than” rule: e.g., all observed levels of net worth corresponding to a cumulative percentile absolutely less than 1 are included in the first percentile, all levels of net worth on the interval [1,2) are included in the second percentile, etc. The highest net worth household is included in the 100th percentile. Total net worth in each percentile group is then summed. Percent of net worth is calculated by dividing each net worth category’s total net worth by the sample total net worth. Cumulative percent of net worth is the running total of the net worth owned by each percentile divided by total national net worth.

For information on the Methodology used by Forbes to calculate their list, see:

Kroll, Luisa. “Inside the 2015 Forbes 400: Facts and Figures About America’s Wealthiest.” Forbes. September 29, 2015. Online.

Tables & Endnotes: For the full collection of tables and full list of citations, download PDF version of the report.

Chuck Collins is a senior scholar at the Institute for Policy Studies (IPS) and directs IPS’s Program on Inequality and the Common Good. He is an expert on U.S. inequality and author of several books, including 99 to 1: How Wealth Inequality is Wrecking the World and What We Can Do About It.

Josh Hoxie joined the Institute for Policy Studies in August 2014 heading up the Project on Opportunity and Taxation. Josh’s main focus is on addressing wealth inequality through the estate tax, a levy on the intergenerational transfer of immense wealth. Josh grew up on Cape Cod, Massachusetts and attained a BA in Political Science and Economics from St. Michael’s College in Colchester, Vermont.

Josh worked previously as a Legislative Aide for U.S. Senator Bernie Sanders of Vermont, the longest serving independent in Congressional history, both in his office in Washington, DC and on his successful 2012 re-election campaign.

Via Institute for Policy Studies under a Creative Commons license.

© 2025 All Rights Reserved

© 2025 All Rights Reserved