In his acceptance speech for his primary victories in Arizona and Michigan, Mitt Romney repeated his pledges to cut taxes 20 percent “across the board” and to balance the Federal budget at the same time as creating jobs and promoting economic recovery.

You don’t have to have had Economics 101 to know that Mitt Romney is peddling snake oil. Massively cutting government spending when the economy is fragile would risk throwing the country into another Very Deep Recession. Tax cuts don’t create jobs– often they send them abroad since they concentrate wealth in the hands of the super-rich, who don’t really care whether the jobs are created in the US or abroad.

But the biggest scam of all is the “across the board” tax cut.

Let us imagine that we were five friends. And let us say that we each paid annual income taxes but at much different rates.

Toni makes minimum wage and doesn’t pay Federal income taxes, though she has to pay the 15% payroll tax that goes toward Social Security.

Jimmy has a wife and two children and makes $60,000 a year, and pays $16,000 in Federal taxes.

Veronica makes $150,000 a year as an attorney and pays $44,000 in Federal taxes.

Jake makes a million a year from his business and pays $200,000 in Federal income taxes.

Mitt makes $20 million a year and pays $2.4 million because it is mostly investment income taxed at a very low rate.

So implement the 20 percent across the board cut.

Toni ends up paying for some things now provided by the government, so she loses what little money she has. Jimmy would save $3200 on the surface, but will lose a child to cholera when the water isn’t any longer purified.. Veronica would save $8,800 to outward seeming but will have to buy a new $25,000 car because her automobile will get totaled because of a pothole on the interstate that the government doesn’t any longer bother to fix. Jake would save $40,000. And Mitt would save $480,000. Do you see how that “across the board” thing works in favor of the very rich?

Taxes are used for common purposes. They pay for interstate highways, environmental cleanup, and all kinds of national infrastructure. If Mitt gets an extra $480,000 to keep, it is not free money. It is being subtracted from the common pot of money that pays for the things we need government to deliver to us. Mitt’s investments are in companies that need their goods trucked around the US, but now he’s cutting money to pay for road building and maintenance. He’s eating the nation’s seed corn.

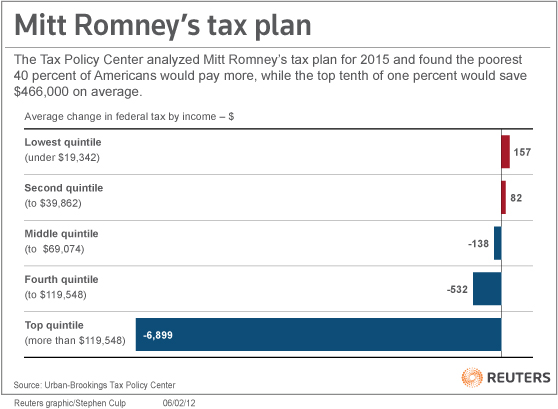

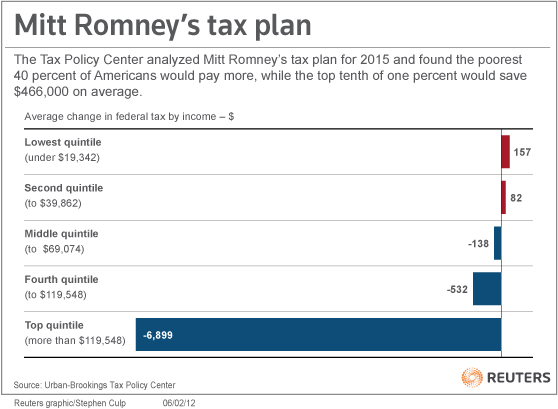

And so this is what his 20% across the board cut looks like in general (a quintile is a fancy word for a fifth of the population).

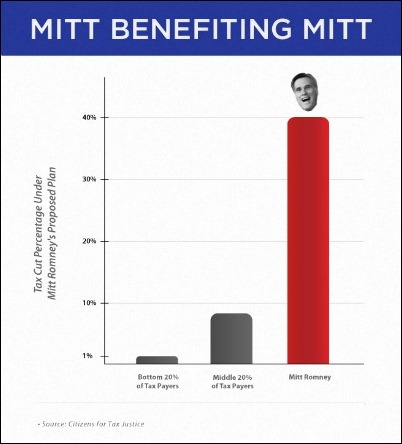

And this is what his 20% tax cut looks like in specific:

courtesy politicsplus.org

In other goods, what Romney promotes is what is good for Mitt and for a few billionaire buddies. He doesn’t care about you if you are in the 99% percent, but he will try to convince you to let him do “across the board” tax cuts that mainly benefit large corporations.

When he says he is going to “fix” social security and medicare (which aren’t broken, aren’t on the verge of bankruptcy, and don’t need any dramatic rescue) what he really means is that he is going to try to get rid of them gradually.

The super rich in the US really, really like 1928, and they hate the New Deal like the devil hates holy water, and they are trying to repeal it. Repealing the New Deal is 80% of Romney’s agenda.

© 2025 All Rights Reserved

© 2025 All Rights Reserved