By Juan Cole | (Informed Comment) –

What is the actual value of the oil, gas and coal fields owned by big energy corporations, which gives them their stock price and allows them to be counted as assets for borrowing purposes?

The real value of those hydrocarbon resources is zero.

Or actually it is much less than zero, since there are likely to be a lot of liability lawsuits and insurance claims for severe environmental and property damage. Coal, oil and gas are now where the cigarette companies were in 1990, on the verge of getting hit with massive penalties. Big Coal and Big Oil are dead men walking.

The only thing that stops the entire world economy, including that of the United States, from collapsing is that investors continue to pretend that what I just said is not true. Because of this pretense, some people will go on making a lot of money with hydrocarbon investments in the short and perhaps even the medium term. Much investment and assignment of value is a matter of confidence.

But the confidence is misplaced. If you are still fairly young and you or your pension fund bought a lot of petroleum or gas or coal stocks in hopes of retiring on them, think again. You will lose your shirt.

Worse, because so many loans and other investments are anchored by the supposed value of coal, oil and gas, the world is walking an economic tightrope and the gentlest of breezes could knock it off into a crisis that would make 2008-2009 look like a minor hiccup.

In particular, if a sizable ice shelf breaks off in the Antarctic, you could see a sudden sea level rise that would panic the public and possibly lead some countries to outlaw things like coal and gas.

The Bank of England is doing a big study of this problem, which economists call that of “stranded assets.” That is a fancy phrase for when you invest in something that suddenly loses its value.

For instance, say you invested in Blockbuster Video Entertainment, Inc., when people used to rent DVD’s of movies from brick and mortar stores. In 2006 it seemed a good stock to buy– it had 9000 stores and 60,000 employees (almost as many as there are coal miners). And then streaming video came along. Stranded asset. Blockbuster went bankrupt in 2010 and survives only as a streaming service of Dish satellite television, which bought it and was gradually forced to liquidate all the stores.

The same thing will happen to coal, oil and natural gas, for two big, inexorable reasons. First, burning hydrocarbons is fatal to the health of our planet– in terms of the energy it releases, it is like setting off atomic bombs constantly. After a while that would take a toll. Second, other far less destructive ways of generating electricity are every day becoming cheaper and more efficient, especially wind and solar.

That coal as an industry is a bad investment should be obvious. The Obama Environmental Protection Agency has decided finally to start actually enforcing the Clean Air and Water Act, and has also claimed the right to regulate states’ carbon dioxide emissions (in which it has been upheld by the Supreme Court). Most coal plants will likely close over the next five years. Can you say, Blockbuster Video? I’d dump those coal stocks, like yesterday, or call my pension fund and make them drop them.

Of course, there was already a social conscience argument against investing in coal, which is dirty– burning it emits mercury (a nerve poison) and other dangerous pollutants and makes people sick. It also causes acid rain. And it is a major emitter of carbon dioxide, the deadliest poison of all. It is a horrible thing.

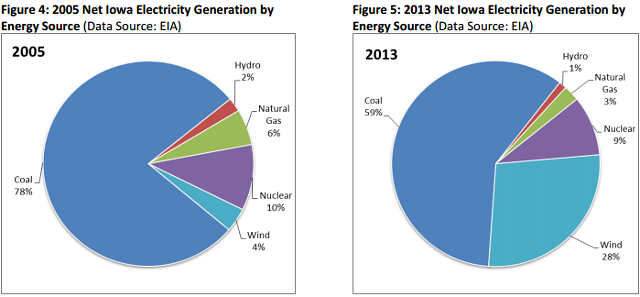

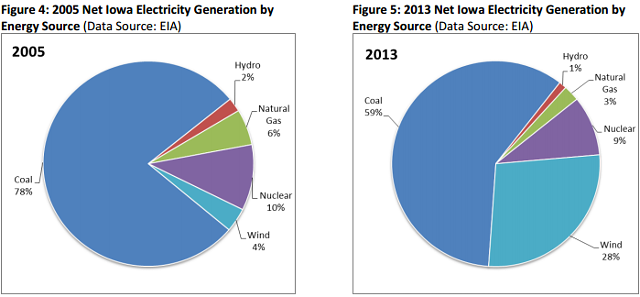

Let’s consider what has happened in Iowa just since 2005.

In 2005, wind generated 4% of Iowa’s electricity. Coal was responsible for a whopping 79%, about 4/5s.

In 2013, wind generated 28% of Iowa’s electricity. Coal had fallen to only 59%.

Given those trend lines, in such a short period of time, does coal look like a good investment to you? Or does wind? Especially since we know what the EPA is planning for coal.

Coal isn’t just competing with wind. The conservative Deutsche Bank has just concluded that in 14 states of the US, solar power is now as inexpensive as that from coal and natural gas. Right now. That is, it would be crazy to build a new coal plant today when you could generate electricity just as cheaply with solar.

And get this: by 2016– next year! — Deutsche Bank concludes that solar will be competitive with coal and natural gas in all but three or four states. And that is not an argument based on subsidies for solar. It will be as inexpensive as coal-generated electricity just purely on a market basis (in fact, it will be even cheaper, since there are massive government subsidies for coal, gas and oil).

Critics say that the wind dies down sometimes and the sun doesn’t shine on half the earth at night. This problem is referred to as that of “intermittency.” But it isn’t an insoluble problem. For one thing, the wind often blows more at night, so turbines can take up the slack from solar plants. For another, there are now molten salt solar installations that go on generating electricity for six hours after sunset. As batteries improve in efficiency and fall in price (both things are happening already, big time), the problem of intermittency will fade into insignificance, likely within a decade.

Another drag is that the electricity grid in many states needs to be redone. Wires need to be laid from the Thumb in Michigan where the wind is to the Detroit metropolitan area where most of the electricity is used. But it really is a relatively minor expense, and since the fuel for wind turbines is free, it would pay for itself fairly quickly. That is just a matter of having a state government that is on the ball and sees where the future profits are to be made. Cheap wind- and solar- generated electricity will allow factories to save money on energy and make their products more inexpensively, allowing them to compete on the world market. A solar facility is helping power the Volkswagon plant in Chattanooga. They’re not paying for coal or gas to produce that portion of their power, because the sunlight is free, and that will make their cars more competitive in price. Some buyers may throw their business to Volkswagen because they are greener. All factory owners will quickly move in this direction over the next few years.

So there isn’t any doubt about it. Buying stocks in coal, gas and oil companies is like buying stocks in zeppelins. They are outmoded and prone to crashing and burning, a Hindenburg waiting to happen. (Zeppelins were good investments once, too; they carried tens of thousands of people across the Atlantic and the top of the Empire State Building was designed to anchor them; but they became a stranded asset.)

It is therefore absolutely amazing that institutions of higher education like Harvard often refuse to divest from oil, gas and coal companies. The science and the economics are clear as day– burning hydrocarbons is disastrous for a city like Boston over time, and holding stranded assets is a one way ticket to bankruptcy court. I couldn’t tell you whether this decision is made out of short-sightedness or out of ethical and moral corruption (universities live nowadays on donors’ donations and don’t want to anger generous alumni who make their living purveying coal, gas and oil).

But those hydrocarbon stocks, and loans made on the basis of those worthless assets, are endangering the economic health of us all. Buying and holding them is the equivalent of refusing to vaccinate your children against measles. It is an individual decision that imperils the rest of the public. You and I may not be able to do much about the Koch brothers’ hold on state legislatures, or about the mysterious insidiousness of the Harvard regents. But most of us have some say in what stocks are in our pension funds or 401ks. There shouldn’t be any coal, gas or oil securities in there. Unless you like the idea of working backbreaking minimum wage jobs into your 80s.

© 2025 All Rights Reserved

© 2025 All Rights Reserved