San Francisco ( Tomdispatch.com) – They call people like us “bean counters” — the soulless ones beavering away in some windowless accounting department, the living calculators who don’t care about desperation or aspirations, who just want you to turn in your expense report on time and explain those perfectly legitimate charges on the company credit card. We’re the ones whose demands are mere distractions from any organization’s or government agency’s true mission.

But maybe bookkeepers and accountants deserve a little more respect. They’re often the ones who actually bring down corrupt officials through dogged attention to those “irrelevant” distractions. It wasn’t for nothing that Washington Post reporters Woodward and Bernstein decided to “follow the money” when they were trying to unravel the mystery of the Watergate scandal. By following that infamous money trail, the two journalists were indeed able to discover secret campaign funds used to pay off the people who had burglarized Democratic Party offices in the Watergate building, along with the men who later covered it up. Eventually that money trail led all the way to Richard Nixon’s reelection campaign, and uncovering it brought down a corrupt president.

If, one of these days, Donald Trump is taken down, it may well be the bean counters who ultimately do it. When it comes to draining the Trumpian swamp, they’ve already done a pretty good job on several of his appointees. Think, for instance of Environmental Protection Agency head Scott Pruitt’s $43,000 soundproof booth and Secretary of Housing and Urban Development Ben Carson’s $31,000 customized dining room set.

The Keys to the Kingdom

I’m old, as I like to tell the students I now teach, so I’ve done a lot of things in my life. For some years, almost by accident, I made my living as a bookkeeper and accountant. (The difference between the two isn’t actually a legal one; often it’s more a question of gender than anything else, with a bookkeeper more likely to be a woman and an accountant a man. A certified public accountant is a licensed professional who has the authority to audit an organization’s books. A regular accountant is anyone who understands debits and credits.)

When I was young, there were generally three career paths open to a woman with a bachelor’s degree: teacher, nurse, and secretary. As a college student in those ancient days before computers took over, I’d refused to learn touch-typing because I was determined never to be a secretary. However, after a stint packing ice cream cones in a factory and a few years as a clerk in Oregon’s state-run liquor stores, I found myself at a temp agency looking for something that might pay a little better. As it turned out, there was a 25-cents-per-hour differential in pay between a “general office worker” and an “accounting clerk.” The latter, however, had to know how to run a 10-key calculator by touch. I admit it: I lied and swore that I could. Eventually, after clicking those keys often enough, I learned how to do it pretty well.

Later, a friend initiated me into the mysteries of double-entry bookkeeping. I learned why debits (and expenses) are positive and credits (and income) negative, and how at any given moment the whole system should total up to a beautiful zero. I worked by hand in those days, making entries in journals with actual pages. The company’s general ledger was an actual ledger: a big, leather-bound book. When it came time to transfer my skills to computerized systems, I counted myself lucky to have a physical, kinesthetic understanding of accounting.

Eventually, I used those skills to give nonprofits a hand in grasping one of the keys to power: understandingtheir own money. I helped them stay out of trouble with the IRS and avoid fines from the California Fair Political Practices Commission. I showed them that their much-coveted 501(c)(3) status did not mean that they had to eschew all political work — that they could, for example, focus on ballot initiatives. I taught immigrant women how to control their own organization’s budget and understand what their financial statements could tell them about where their money came from and how they were spending it.

Who invented this brilliant system of debits and credits? Arguments over this still rage — albeit in dusty corners of the academic world. It seems clear that a fifteenth-century Italian mathematician, Luca Pacioli, wrote the first formal treatise on the subject of accounting, laying out the system pretty much in its modern form. But claims have been made for earlier origins in disparate parts of the medieval world, including India, the Islamic empire in northern Africa and the Iberian Peninsula (today’s Spain and Portugal), and imperial China.

It’s clear at least that, without Arabic numerals (courtesy of the medieval Arab mathematicians, who also gave us algebra), double-entry bookkeeping would have been impossible. Without systematic double-entry bookkeeping — to accurately record not only what an enterprise receives and spends but what it is owed and owes — capitalism itself would have been almost inconceivable. Today, understanding how money is counted and accounted for offers those of us who seek to expose capitalism’s plundering and exploitation a powerful tool for laying bare thieves of state like Donald Trump.

Counting Beans

Maybe accountants and all the rest of us should stop thinking of the epithet “bean counter” as an insult. What could be more important, after all, than keeping track of humanity’s most basic needs? We need to count the foods we eat, the stuff we drink, the clothes that cover us, and the plants and animals they come from. We need to know if we have enough and to make decisions about how to use any surplus our labors generate. Do we invest it in projects that serve the common good (health care, education, libraries, parks, renewable energy, infrastructure) or do we transfer that surplus into the hands of a very few, creating a global gilded ageof plutocrats on a planet in danger of becoming uninhabitable?

It’s only by such accounting that we can grasp what expressions like “wealth disparity” and “income inequality” actually mean in people’s lives. If you’ve been poor, you know what it is to be cold or hungry, to feel anxiety about tomorrow’s meals and where they’ll come from. In 2016, the U.S. Department of Agriculture reported that this anxiety, called “food insecurity” by the experts, affected at least one in eight Americans. That’s 42 million people, 13 million of them children. And that was before House Agriculture Committee Chairman Michael Conaway proposed to slash the Supplemental Nutrition Assistance Program, or SNAP (formerly the food stamp program), over the next 10 years, by more than $20 billion. Such vicious cuts constitutea minor “fix” in response to the staggering federal deficit — expected to increase $1 trillion by 2020 and $1.9 trillion by 2028 — thanks to President Trump’s tax “reform” bill. The proposed SNAP reductions are to be accompanied by punitive new work requirements — despite the fact that, as the Center for Budget and Policy Priorities (CBPP) explains, most recipients are already working — even if at precarious, unstable jobs.

The

CBPP, by the way, is an excellent example of the contributions to human well-being of people who know how to count beans — and dollars. The members of that group dig deep into every federal budget to reveal the often-hidden national priorities it represents. They work ceaselessly to present a vision of national security based on the actual security and well-being of the people of this country, rather than on using our military forces to destroy the security and well-being of people in other nations.

Not only has such bean counting helped keep us food-secure for much of human history, history itself — as defined by written records of human activity — began with the need to count beans, or more generally to keep track of things people needed for food, drink, and clothing. The earliest Mesopotamian writings are enumerations on clay tablets of wheat, sheep, and importantly, beer. From this written method of counting and recording things emerged the first writing systems. And writing in turn, allowed us to preserve for the future our species’ history and all the great literature of the world, from the Hindu Vedas to Sappho’s lyrics to Kendrick Lamar’s hip-hop rhymes.

Follow the Money

But how, to return to the present, are the bean counters supposed to bring down Donald Trump? By following the money to reveal the international morass of gangsterism and corruption that is the Trump Organization. First, they’ll have to pick off his venal appointees like EPA director Scott Pruitt, with his penchant for first-class flights, $100,000 SUVs with bullet-resistant seats, and frequent flights home to Oklahoma at taxpayer expense. Interior Secretary Ryan Zinke has taken airborne luxury a step farther, preferring to charter private planes for his travel — like the $12,375 taxpayers spent to fly him the thousand miles from Las Vegas to his hometown of Whitefish, Montana.

Then there are the people who worked on Trump’s campaign. Special counsel Robert Mueller has already indicted former Trump campaign director Paul Manafort and his deputy Rick Gates for laundering $18.5 million earned for lobbying work they did in Ukraine and this country. Following the bean trail also led prosecutors to uncover Manafort’s and Gates’s $2 million payments to a Washington lobbying firm working for Ukraine’s former president, Viktor Yanukovych, and his pro-Russia party — although the two Trump campaign workers had never registered as agents for this foreign client. You may recall that Michael Flynn, briefly Trump’s national security adviser, found himself in similar trouble for failing to register as an agent of the Turkish government.

Closer to home, there’s Jared Kushner, Trump’s son-in-law and security-clearance-less adviser on all things Mexican and on bringing peace to the Middle East. Following the money trail allowed New York Times journalists to report that Kushner’s real estate business got startlingly large loans from Apollo Global Management, one of the world’s biggest private equity firms. That was after he had several meetings at the White House with one of the company’s founders, Joshua Harris, who was reportedly under consideration for a White House job, although, as the Times indicates, “the job never materialized.” The Apollo loan refinanced an already-mortgaged Kushner family “Chicago skyscraper” and “was triple the size of the average property loan made by Apollo’s real estate lending arm.”

Then there was the under-reported Deutsche Bank-Trump-Kushner connection, which Congresswoman Maxine Waters has doggedly pursued and Mueller is now investigating. The bank, suspected of using so-called mirror trading to launder money for Russian oligarchs, has loans with Trump’s real estate business totaling as much as $364 million; Deutsche has also extended lines of credit in the millions of dollars to the Kushners. Some might consider that a possible significant conflict of interest for a U.S. president. CNN has also reported that Mueller interviewed “at least two Russian oligarchs” about possible contributions to the 2016 Trump campaign.

It’s not just Deutsche Bank that has occasionally bailed out the Trump and Kushner operations with mega-loans. As the Nation magazine reported, both operations have long relied on the kindness of Russian bankers:

“The Trump and Kushner families, a marriage (via Ivanka) between two of New York’s leading real-estate dynasties, are multiply connected to Russian real-estate deals. ‘We don’t rely on American banks,’ said Eric Trump back in 2014. ‘We have all the funding we need out of Russia.’”

None of this should be too surprising, given what is apparently a long association with Russian gangsters and their oligarch bosses. As former Wall Street Journal reporter Glenn Simpson told a congressional committee, Trump “built relationships with Russian gangsters who were themselves tied to the Russian government.” Those ties were related to money-losing golf courses in Ireland and Scotland. Simpson testified that Trump’s gangster ties go back decades to his association with the Italian mafia, whose loans may well have kept some of his businesses afloat. But wait, there’s more! In Panama, the Trump Organization lent its name to the Trump Ocean Club Panama, a high-rise condo where Russian and other organized-crime figures evidently used the purchase and sale of units to launder millions.

And then there’s that potential firestorm of a subject: Did the Trump Organization use real estate deals to launder money from global criminal activities of various sorts? The New York Times describes a number of possible deals involving shady characters in countries from Azerbaijan to Panama, not to mention the U.S. Such deals may well have allowed government officials and other thieves to turn ill-gotten gains into clean money by parking it in shell corporations, which then invested in real estate. When condos or shares in a building are sold to another party, hey presto, the dirty money is now clean.

Suspicions have long been rife that Trump & Co. were neck deep in the dismal swamp of pay-to-play money laundering and other I’ll-scratch-your-back-you-scratch-mine corruption schemes. But no one will be sure until the bean counters get their hands on the appropriate documents and lay out that money trail, dollar by ruble by hryvnia by peso, for Robert Mueller and others to follow. And when that happens, we can thank the women and men clicking their calculators and filling their spreadsheets in the accounting department.

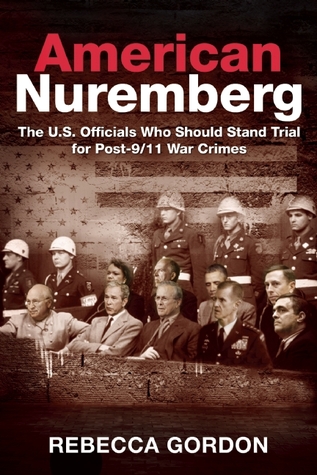

Rebecca Gordon, a TomDispatch regular, teaches at the University of San Francisco. She is the author of American Nuremberg: The U.S. Officials Who Should Stand Trial for Post-9/11 War Crimes. Her previous books include Mainstreaming Torture: Ethical Approaches in the Post-9/11 United States and Letters from Nicaragua. Prior to her academic life, she worked as an accountant for a variety of nonprofit organizations, including as controller of the Tides Foundation in San Francisco.

Follow TomDispatch on Twitter and join us on Facebook. Check out the newest Dispatch Book, Alfred McCoy’s In the Shadows of the American Century: The Rise and Decline of U.S. Global Power, as well as John Dower’s The Violent American Century: War and Terror Since World War II, John Feffer’s dystopian novel Splinterlands, Nick Turse’s Next Time They’ll Come to Count the Dead, and Tom Engelhardt’s Shadow Government: Surveillance, Secret Wars, and a Global Security State in a Single-Superpower World.

Copyright 2018 Rebecca Gordon

Via Tomdispatch.com

© 2025 All Rights Reserved

© 2025 All Rights Reserved