Ann Arbor (Informed Comment) – Yale Environment 360 points to recent energy reports as suggesting that China will hit peak gasoline next year. That is, after 2024 the country’s demand for gasoline to fuel automobiles will fall every year. China was one of the last advanced economies to lift COVID-19 restrictions, as President Xi Jinping abandoned the strict “no-COVID” lockdowns last fall in the wake of urban unrest. So gasoline demand rebounded in the first half of 2023.

China is expected to import about 10.8 million barrels a day of petroleum in 2023, a 6% increase over last year when large cities such as Shanghai were still in lock down, according to Reuters. Its total petroleum demand this year is expected to be 14.86 million barrels a day. The country produces about 4.3 million barrels a day of its own oil.

For comparison, in 2022 the US imported about 8.2 million barrels a day of petroleum, though it exported 9.58 mn. b/d, so it was a net exporter by about a million and a quarter barrels a day. US production is expected to peak in 2023 and then to decline because some of the most productive fracking fields are shallow and becoming worked out.

In the meantime, however, China has gone in for electric vehicles in a big way, so that they make up a third of new vehicle purchases. This year and next will be the last hurrah of gasoline in that country, and then the International Energy Agency expects electrification of transportation will start Chinese demand on a rapid downward path.

The authors of the IEA report point out that as of last January there were about 28 million electric cars on the road globally. Just in 2023-2024 more than another 28 million are expect to be sold. By the time we get to 2028, just five years from now, they expect 155 million EVs to be out in the world — fully half of them in China. That number of electric vehicles will mean that 2.3 million barrels a day of petroleum demand growth will evaporate, along with 630,000 b/d of diesel. Hence, the demand growth will be reduced to a few hundred thousand barrels a day — a figure that is in the oil world barely worth mentioning. Currently the world uses about 100 million barrels a day.

So China may never import much more than 10.8 million barrels a day of petroleum, and indeed we can expect it to import less and less in coming years.

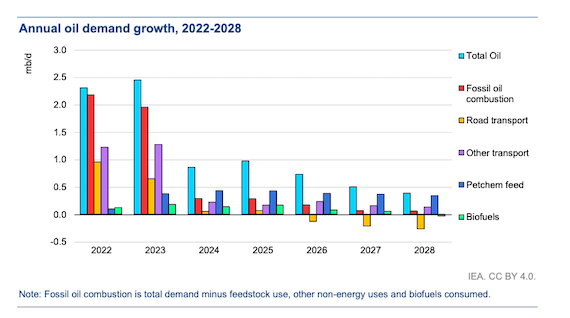

The IEA therefore sees the growth in the world’s over-all demand for petroleum shrinking from 2.4 million barrels per day to just 400,000 barrels a day in 2028. That is, there will still be a very minor increase in demand, but it will be negligible. While China will be using less petroleum in 2028 than it does now, its demand may be replaced by that of developing countries that will find it more difficult to transition to electric transportation because such a switch requires building new infrastructure and they are poor. Oil states like Saudi Arabia are counting on global south demand from Africa, Asia and Latin America, to replace the former demand from electrifying North America, Europe and China.

The global demand growth for petroleum from about 2026, however, will not be in the form of gasoline, which will see shrinking demand, but for other petroleum products such as petrochemicals or jet fuel, as this chart from the IEA shows:

While the IEA is probably right on the five-year timescale they are discussing, I suspect the South will get electrified faster than we now imagine. For one thing, BYD, NIO, Ford, Chevy, Toyota and other automobile companies are going to want to sell their electric cars in Afro-Asia and Latin America, and they will build out, or lobby their governments to build out, charging stations in the global South as a form of foreign aid and climate change amelioration. It is also likely that if we look out ten years, EVs will plummet in price as batteries get cheaper and new technology comes on line, so that Indians and Bolivians will increasingly be able to afford EVs. Some projections have their price falling to $6,000 in twenty years.

So, the upshot is that for China, peak gasoline is around the corner, and for the world as a whole it may be only seven or eight years off.

© 2025 All Rights Reserved

© 2025 All Rights Reserved